Following the initial launch of Credit Sesame 2.0, the team continued working towards feature parity by focusing on Auto Loans because it generates about $25,000–$44,000 per month for the company.

I audited the current auto loan web app experience and discovered the page has broken interactions and is not responsive. It also lacks meaningful information about the loan offers, hindering users from making an informed decision. All these attributes contribute to making a subpar, somewhat sketchy, and absolutely frustrating experience for our users.

Although the current auto loan experience brings in some revenue, I couldn’t help but wonder how much more the company could earn if the experience were better.

Before brainstorming solutions, I first wanted to understand the user behavior when shopping for an auto loan online, specifically at credit score sites like Credit Sesame. I collaborated with another designer in coming up with questions to ask our users:

We learned from 5 user calls:

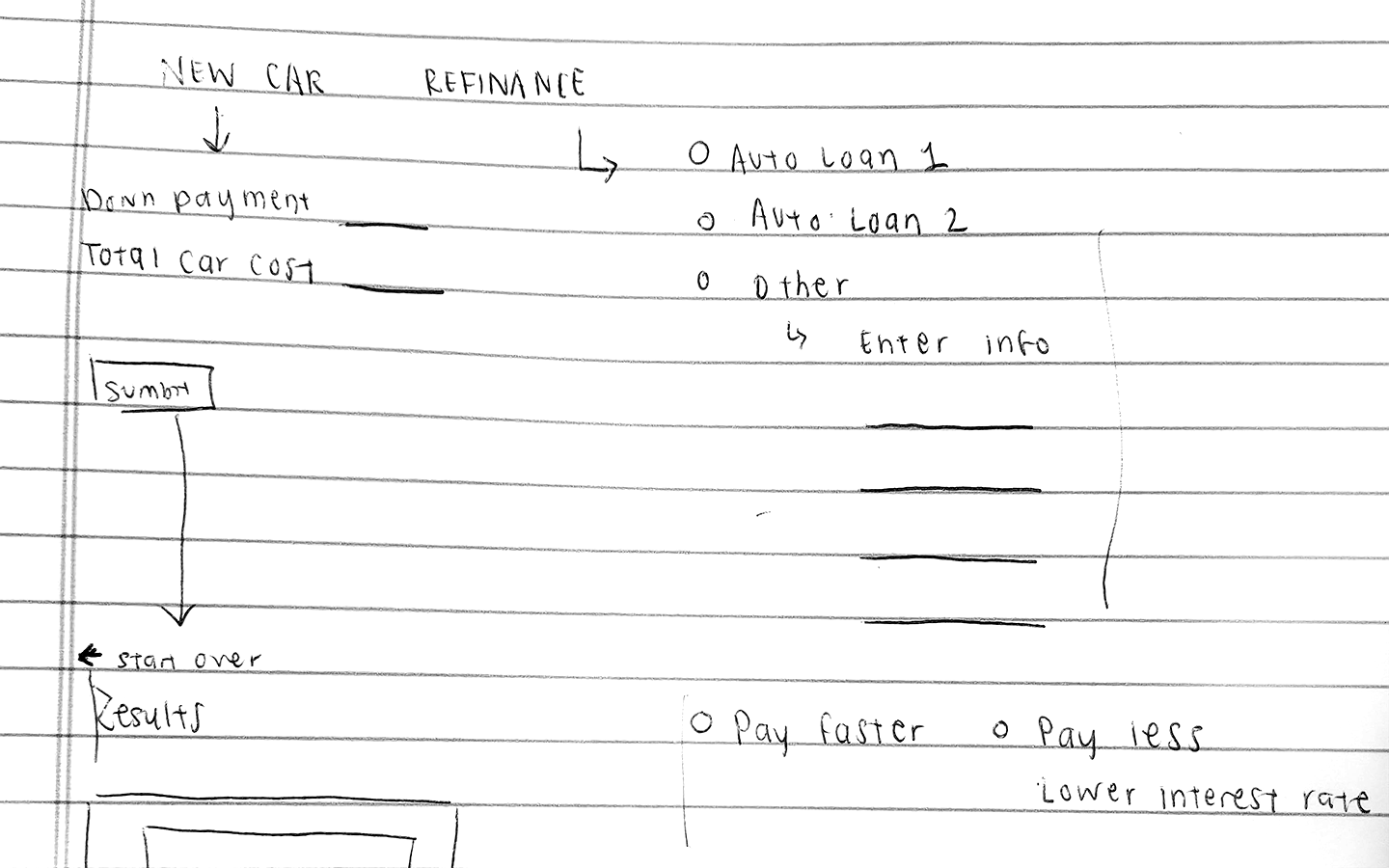

Armed with a better understanding of our users, we brainstormed a very rough user flow.

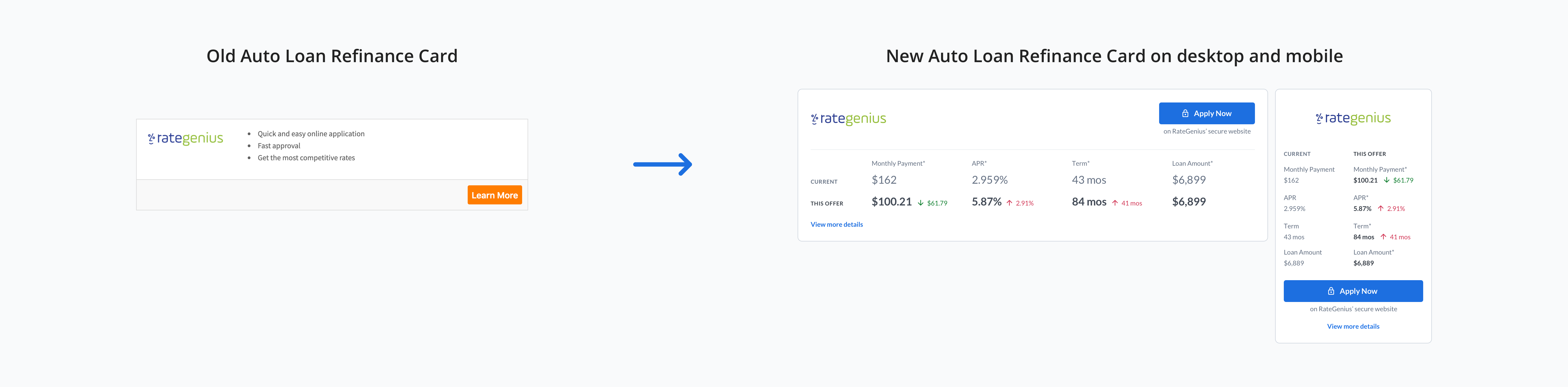

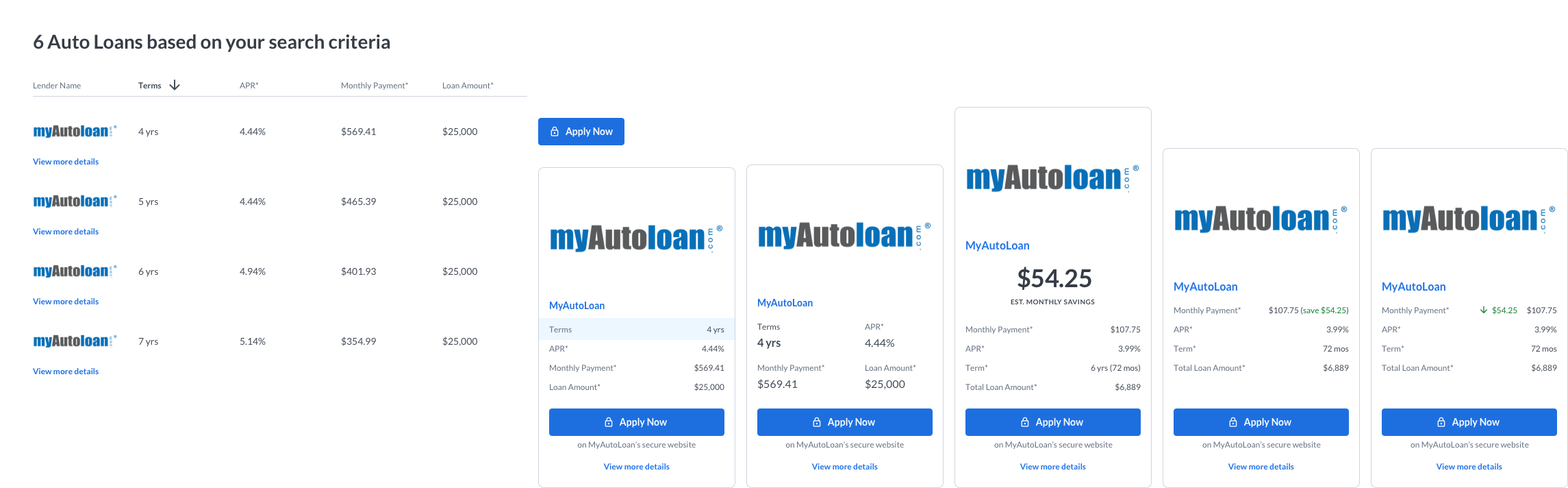

One of the key elements of the page is the offer cards. I explored a few options on how to best present the data points to help users make an informed decision.

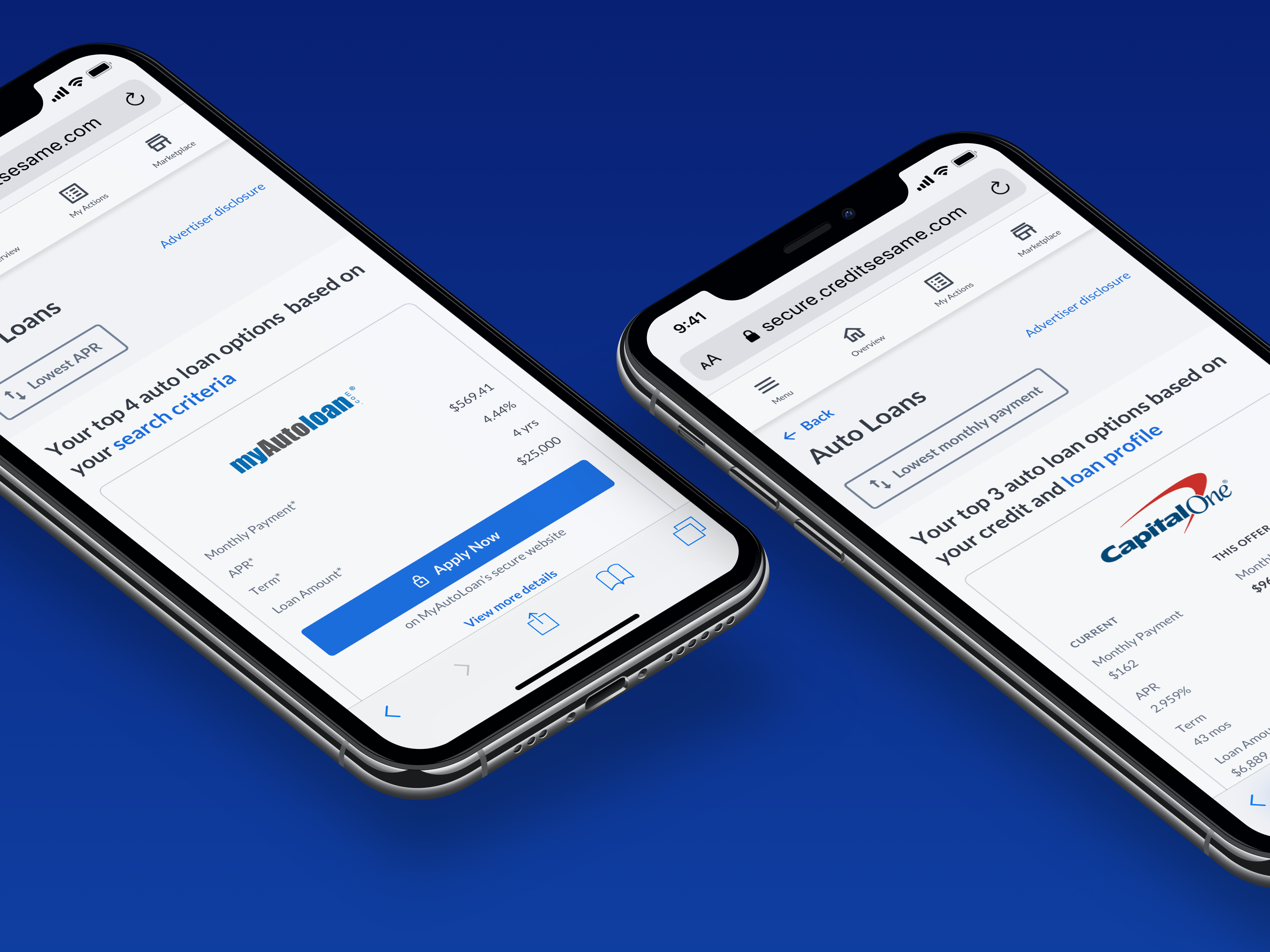

After some explorations, I mocked out the screens and stitched them together in Invision to evaluate the designs with our users. The redesign received overwhelmingly positive comments from 10 usertesting participants. All of the testers strongly agreed that the information is useful, and that the flow is intuitive.

2 participants suggested having an option to save/bookmark their search queries. I shared these insights with the product manager, and we agreed to explore this suggestion in phase two.

Feeling confident with the designs after listening to the user feedback, I reviewed the mocks with stakeholders, and made minimal changes before handing them off to engineering.

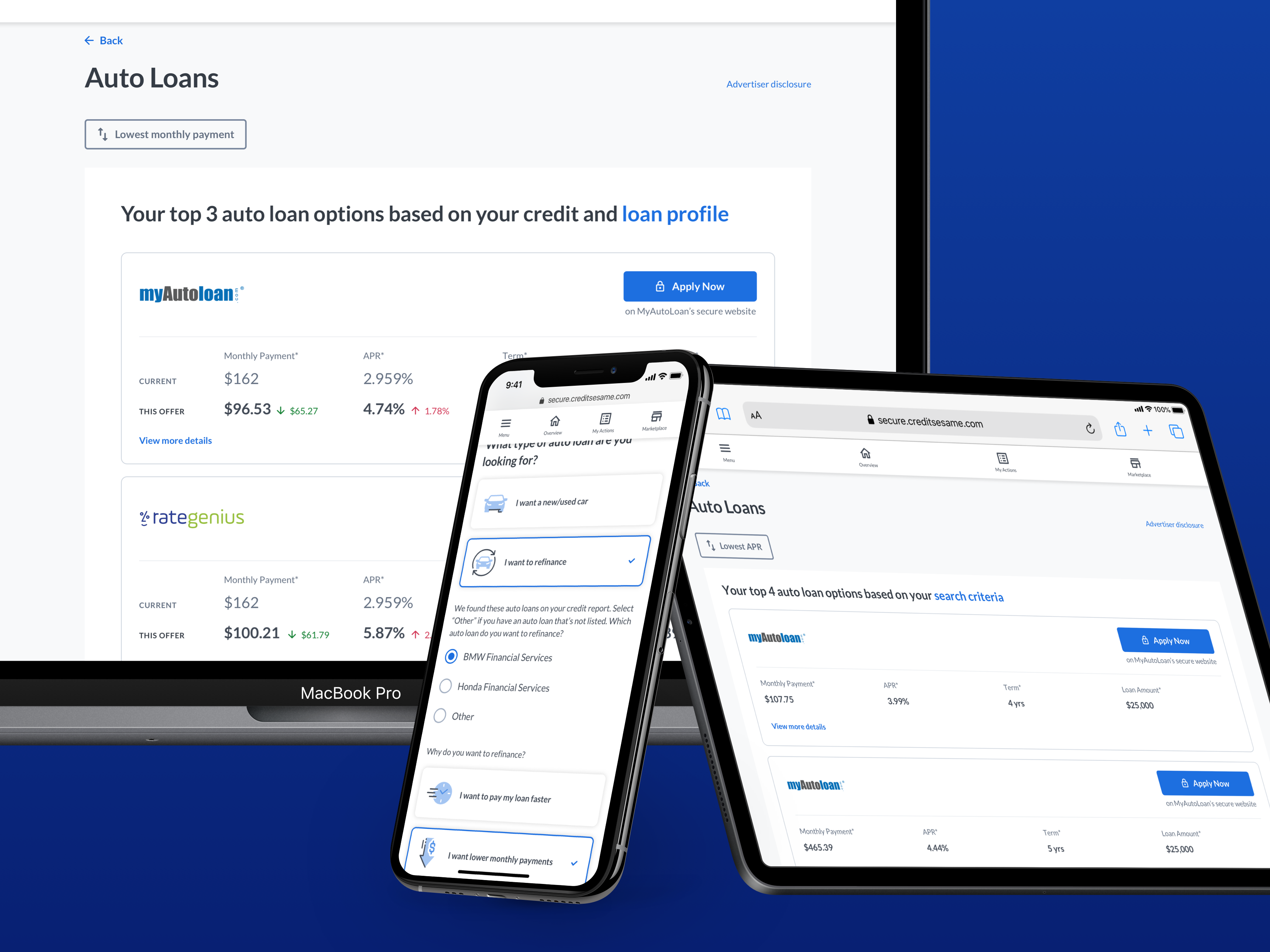

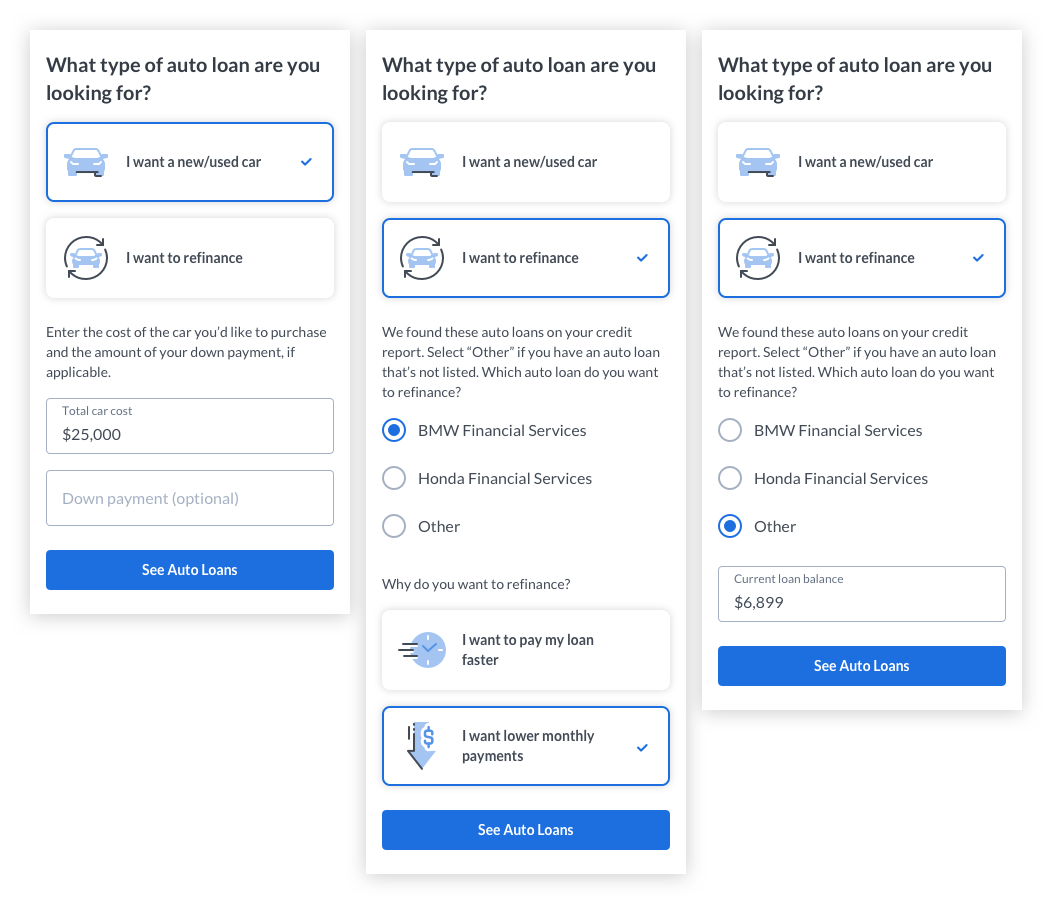

The new auto loan experience starts with a brief questionnaire. Instead of making assumptions on behalf of the user, they have control of their search query. Knowing what they’re looking for helps us better curate offers to them as well. For the refinancing questionnaire, an “Other” option is provided if the user has an existing car loan that is not reported on their TransUnion credit profile.

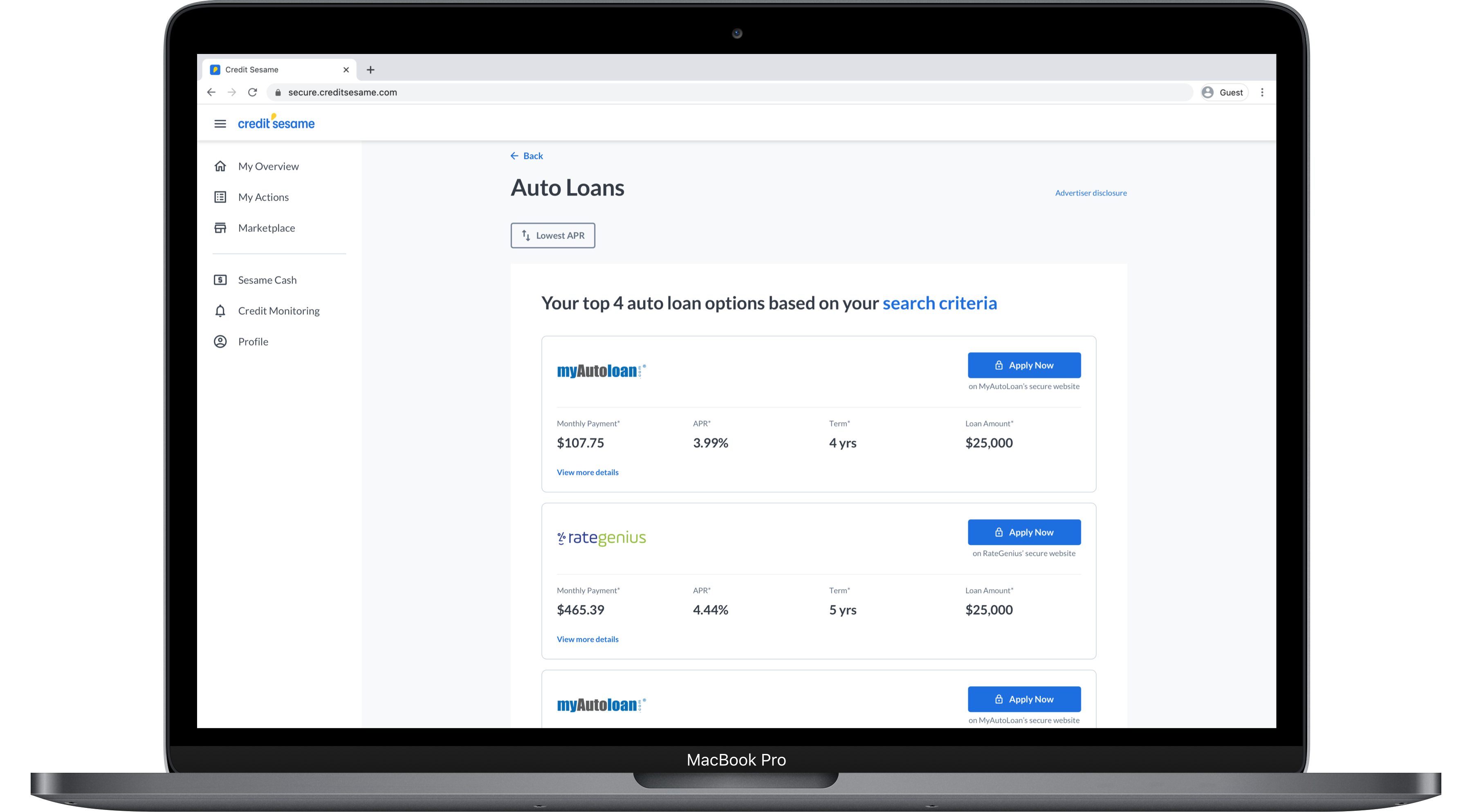

Users can easily sort and find offers that best fit their needs by selecting lowest APR, lowest monthly payment, or shortest term.

In the new auto loan flow, auto loan offers have bolded data rates to call the user's attention.

In the refinance flow, auto loan offers immediately show a comparison. The user no longer needs to spend an extra click/tap to see the differences between their current loan and the offers.